VAT Registration

Mandatory Registration:

If a Business is exceeding its turnover than 37500 BD in last 12 months or expected to exceed the threshold in next 30 days.

The Person (Individual/company) has to apply for VAT registration as per the guidelines and also notify authorities for the date from which VAT will be applicable.

Voluntary Registration:

The Voluntary Registration Threshold shall be AED 18750 (one hundred eighty-seven thousand five hundred dirhams). Where a Person applied to register voluntarily in accordance with the provisions of the Decree-Law, the Authority shall register a Person with effect from the first day of the month following the month in which the application is made, or from such earlier date as may be requested by the Person and agreed by the Authority.

VAT Return Filing

- VAT Return should be filled every quarter as per the guidelines by the end of every quarter.

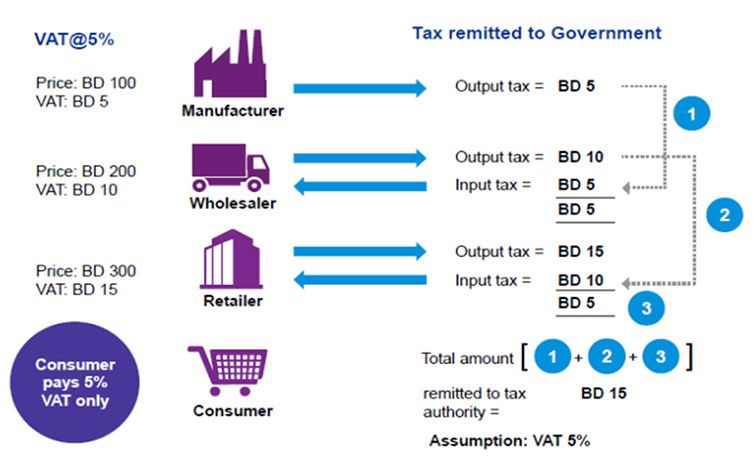

- When a Business performs sales, output VAT has to be collected from consumer.

- When a business, buys goods for the purpose of business Input VAT can be claimed back.

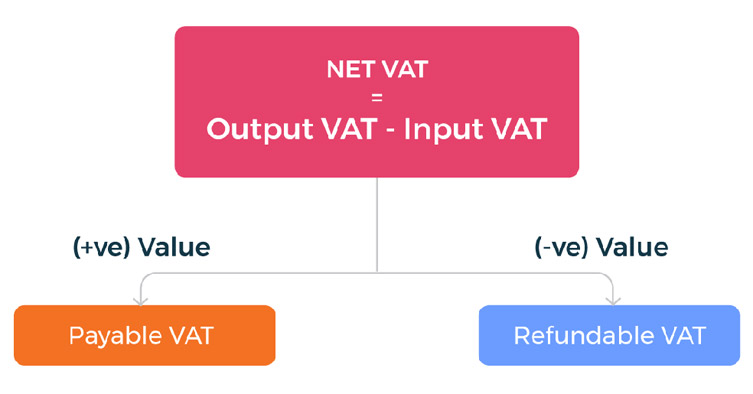

VAT Payable = Output VAT-Input VAT

VAT Returns Filing has to be done through online portal of the Nation Bureau for Taxation(NBT) available under e-services. The form used for VAT return filing is called Form VAT 201. A taxable person is responsible to submit VAT return in the UAE in the prescribed format given by the NBT. Every taxable person is required to submit the VAT Return within 28 days from the end of each Tax period prescribed by the NBT. This must be in accordance with the provisions of the Bahrain VAT law. The taxable person is also liable to remit the amount of tax due to the NBT within the time frame specified by the Bahrain VAT Law; ie within 28 days from the end of each tax period.

How do we help you for filing your VAT Return

Our Tax professionals in VFM Accounting & Bookkeeping can support you in the following areas:

- We will visit your office on a periodical basis (weekly/monthly/Quarterly) to compile the information for filing the VAT Return. At the end of each VAT return period, we prepare the VAT return of behalf of your company in accordance with the provisions of Bahrain VAT law.

- We ensure that the VAT returns are filed within the specified time in each tax period.

- Proper guidance for the payment of Minimal Tax Liability as per the provisions of the Bahrain VAT Law will be advised.

- Optimal Tax Planning for the company will be done.

- We will be available to represent in front of the authority on behalf of you as and when required.

How the VAT returns – Form – is filed?

VAT Returns are to be filed through online portal of the NBT. One has to access the VAT Return Form by login into the e-services of the NBT portal by using the respective user name and password. Our Tax Expert will help you fill the VAT return form with all relevant information within the due date prescribed by the authority.

What are the information to be provided in the VAT Return?

The VAT return discloses the Tax amount due (or refundable as the case may be) for a particular Tax Period. One has to disclose the total output tax payable as well as the input credit available against such Output separately. Excess of Output Tax over and above the Input Tax for a tax period is the amount of Tax Liability to be paid. The content of the VAT Return Form includes the following:

Output Tax:

- Tax Liabilities under Standard Rated Supplies (10%).

- Tax Liabilities on goods imported through customs.

- Tax on goods imported on which tax liabilities are not created – if any.

- Tax liability on import of services.

Input Tax:

- Tax on Standard Rated purchases

- Tax on Standard rated expenses.

- Tax on import of goods

- Tax on import of services

Tax amount disclosed under Output Tax over and above the Input Tax is the amount to be paid to the NBT for a particular tax period within the due date.

VAT Compliance

VAT can represent a key factor in a business’s cash flow and potentially a real bottom line cost. For finance and tax directors, managing VAT risk and its cash flow implications can be a significant challenge which is often compounded by constantly evolving case law, Statute and NBT guidance. Poor compliance and errors can result in penalties, damaged reputation and/or missed opportunities. Whether you are looking to reduce your VAT compliance risk or mitigate unnecessary VAT loss through structuring VFM have the technical insight and skills to assist.

How we can help

We provide the following VAT compliance services:

- VAT registration – completion of the required documentation to register (or de-register) your business, company, partnership or group for VAT.

- Completion of VAT returns – completion of monthly or quarterly VAT returns (based on information provided by you) and submission of those VAT returns

VAT Audit

What is VAT Consultancy Service?

VAT Consultancy Service is one of the services that we provide as a VAT Consultant in Bahrain. Our Service is to provide support and guidance to the registered individuals and businesses for VAT in Bahrain as per the updates and guidance issued by the NBT. As your VAT consultant in Bahrain, we will advise and analyse the impact of VAT in your business and guide you to comply with the VAT law. At times of challenges being faced by business we as your VAT Consultant in Bahrain, can give proper and apt guidance on the process and administrative requirements are every registered individual and businesses must follow.

Why is VAT Consultancy Service Required?

It is very important for the registered individuals and businessesin the UAE to comply with Bahrain VAT laws and regulations issued by NBT and take necessary action to comply with VAT in Bahrain. On a regular business, it might be difficult to look into every VAT compliance requirement and also to ensure their completeness too. At this juncture as VAT Consultants in Bahrain, with our expertise and knowledge in the related field after encountering practical scenarios which we face on a day to day basis, we shall extend our guidance, support, execution and resolution on the all your challenges encountered which will be based on the provisions and guidelines issued by NBT. As VAT Consultants in Bahrain we will have a readymade cum tailor made tax solutions for businesses in the Bahrain.

How Doeas VAT work in bahrain